Passive Component Industry Looks Optimistic Next Year: Industry

2020/11/23 | By EDNThe passive component market could see sustainable yearly growth next year, at approximately 11.1%, markets say, with production capability around 10% and annual demand around 15%. Forecasts also indicate that MLCC and R-chip prices could grow in Q2 and Q3 next year.

Domestic market reports point to the growing demand for 5G-capable smartphones, electric vehicles (EV), and automotive electronics, fueling growth in global passive component industry values.

In traditional 4G smartphones, passive components usually require 750 to 800 pieces. That number can double or triple in 5G smartphones, requiring over 1,000 passive components.

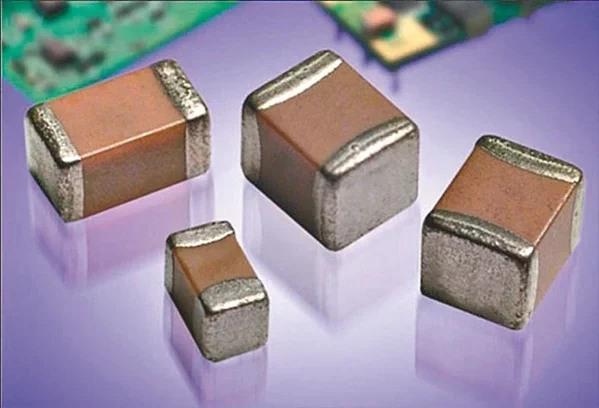

For automotive use, passive component demand in automotive entertainment systems, ADAS, and AIoT has increased. With EV demand buoying the growth, this year saw usage of auto electronics and electric vehicles increasing to 35% and 50%. MLCC, resistors, and capacitors are the key components for automotive electronics, with the markets eying sustainable growth in these areas.

Taiwan-based electronics component firm Yageo, analyzing Taiwanese firms' orders and activation conditions, said the firm's activation is gradually increasing, yet recruitment has been difficult. Activation is currently around 80% and expects to continue to rise above 80%.

Yageo said orders up before Chinese New Year are locked, yet said 2021 remains up in the air, as some are long-term orders. Inventory-wise, the firm said it's likely impossible to replenish inventory stock before the Chinese New Year.

Walsin Technology pointed out order visibility remains clear for three months, including MLCC and R-chip components could average activation at 90%.

Walsin Technology's inventory for passive components remains below 45 days for inventory periods, while the average period inventory is around two months.