Global Furniture Industry Highlights

2009/10/07 | By Judy Li

The Big Sleep—the comfortable world of mattresses

There’s never been a better time to rest easy in the bed department. Mattresses, in particular, are resurrected as the savior of this division. Customers want comfort, as they always have. But particularly, in a time of economic uncertainty, this personal space for rest and relaxation is being emphasized as a significant safe haven; a place to retract from the quagmire.

Cognizant of the considerable investment that home owners are now embellishing on their domestic domains, the manufacturers and wholesalers are responding in kind. Dura Beds, for instance, has launched what it deems an exciting new addition to its Pocket Spring collection—Silk Serenity. Sub-branded as Touch of Nature, the mattress contains individual pocket springs, and together with luxurious high slick thermal bonded polyester fillings, it provides a sumptuous sleeping foundation. Upholstered in a super soft knitted fabric with the additional feature of side stitching on the mattress border, the divan base also features a bumper bar and twin-wheel castor.

Balmoral, a mattress manufactured in the traditional way giving the individual sleeping support that only pocket spring can provide, its combination of fillings allows the sleeper to experience a firmer and more supportive night’s sleep. Upholstered all over in a luxurious hard wearing, contemporary Belgian damask fabric, this model—according to sales director Douglas Mitchell, represents outstanding value for money.

“Based in Batley, West Yorkshire, Dura Beds was formed around 11 years ago by two close friends—Imran Akhtar and Islam Khan—who are now joint managing directors,” says Mitchell. “In 2006, the company invested heavily in additional, up-to-date manufacturing machinery to enable the company to offer a wider range of micro quilt, and tack and jump upholstered mattresses.”

“Using the latest technology in fillings such as high slick, thermal bonded polyester, visco elastic memory foam combined with pocket springing, dual springing and traditional bonnell springs, Dura Beds has created a range to suit most tastes and pockets,” states Mitchell.

Elegance, for example, is a recent addition to the micro quilt collection. Featuring a super soft cashmere fabric which is micro quilted into luxurious layers of polyester and foam. The fillings combine together with an ortho firm bonnell spring unit to provide a considerable amount of comfort and support.

“Silk Sensation is another new addition and it features a luxurious knitted fabric micro, quilted into generous layers of polyester and foam. The combination of fillings, together with the firm foundation provided by the spring unit, makes this bed firm yet extremely comfortable,” he says.

Building on existing successes and forging ahead with new designs are apparent hallmarks of a successful mattress company. At Norris Bedding mattresses manufacturing continues, as it has done since 1945.

“When we started grading as RJ Norris, a small family firm, at that time materials were hard to come by, so expertise in upholstery and refurbishing mattresses were essential,” says Tony Norris. “Time has changed and the name has changed to Norris Bedding Ltd. But we’re still a family firm, now specializing in fine quality handmade mattresses. Often these are purchased for antique beds, but many people simply want a standard size mattress of super quality at a very comfortable price.”

Relatively new, in comparative terms, Express Foam Ltd.—Snug Mattress has been established since 1997. “We have made quite a large investment in new computerized cutting technology, vacuum roll packing machinery an telecommunications to produce excellent products and customer service,” informs Michael Winstone, managing director. “All mattresses feature computer-cut castellated-zoned ventilation channels to five optimum support for hips, back, pelvis and increased airflow for extra comfort.”

Velda has been in operation for over 50 years. Since 1954, the Belgium-based outfit has supplied a varied and high quality product range, which is manufactured by a dedicated workforce, using the finest raw materials.

“Our mattress range features pocket springs,” says Denise Underhill. “Latex and memory foam with five and seven zones provide excellent support. And all models have removable covers for dry cleaning.”

“The Bodyprint range of memory foam mattresses feature unique benefits and features,” continues Underhill. Adding: “These include the Aerotech border system and also the Aegis premium technology. These protect fibres of the mattress ticking against micro organisms, such as bacteria, fungi and dust motes.”

Setting the benchmark for quality and performance, the Hotelier from Vogue Beds Contract Solutions has a hand-tufted mattress that contains a 12.5 gauge spring unit with a 9 gauge frame. Firmness and comfort combine to make it the ideal bed for hotel sector and other contract markets.

The Hotelier is a mid-range mattress and includes air vents with the border vertically stitched. Tailored to the needs of the contract market, it combines durability, comfort and affordability and is finished in a quality cotton fabric with totally fire retardant fillings that fully meet today’s legal requirements.

Suitable for metal or pine bedsteads, the Hotelier is ideally complemented by Vogue’s newly launched Chenille deep and shallow bases. An ottoman version with gas-operated opening, it is also available when maximum storage is required. The bases—in Sand, Mocha or a newly-launched Mulberry fabric—are fully upholstered with twin piping, so there is no need to cover it with a valance and it comes with twin castors and linking bars.

In tune with today’s contract market, quality, comfort, durability, service and cost-effectiveness are central to Vogue’s ethos. The compressive collection of contract bed types embraces everything from standard open coil units and pocket spring units, to those utilizing memory foam which shapes to contours of the body.

As a result of its extensive experience in both the contract and retail sectors, Vogue is well placed to meet the needs of virtually any contract customer. As well as “off-the-peg” ranges, the company can provide bespoke solutions to meet individual specifications within demanding lead times.

The Swift Mattress Company has been established in answer to an increasing demand for luxury mattresses and bedding systems in the boating, caravan and mobile home, private plane, holiday home and rail transport industries.

Bespoke mattresses—in foam and memory foam—can be produced in a variety of shapes and sizes. All are vacuum-packed for easy storage and distribution; fast deliver is guaranteed. The Swift Mattress Co. is part of the Vogue Beds Group, one of the UK’s leading designers and manufacturers of bedding systems specialists.

Sealy has just launched its latest Posturepedic bed range—heir most technologically advanced bed ever. The beds have seven different zones along their length, each tailor-made for a different part of the body.

Scientists say the body needs to gently move 35 times a night in order to reoxygenate its muscles and keep the blood circulating smoothly, according to the company. This movement, however, is not the same as tossing an turning which uses energy and leaves us feeling more tired when we wake up than when we went to bed.

A spokesperson for Sealy said: “Tossing and turning happens because some parts of our bodies are heavier than others, creating areas of concentrated weight and pressure and causing loss of circulation leading to numbness and pins and needles.”

“The automatic reaction by the body is to move and turn over to lie in a different position. But, the more supportive your mattress, the more pressure points are created, and the more pressure relief offered, the less support you get. To eliminate these pressure points, ideally you need both push-back support and maximum pressure relief. The problem is that there are all sorts of different beds available and each offers different options,” he added. “However, memory foam beds relieve pressure but give poor support and can also be very warm. Pocket sprung beds provide comfort but poor pressure relief and traditional continuous coil beds provide goods support but limited comfort.”

“This new Posturepedic mattress deals with all problems through appropriate zones, individually designed to provide maximum pressure relief but with the equally important push back support,” he emphasized. “Also provided is maximum comfort and temperature and moisture control to stop you feeling too hot or too cold. These are the only beds that tick all the boxes to help you get a Sealy better night’s sleep.” (Excerpted from the United Kingdom’s Cabinet Maker issued May 15, 2009)

Dining’s In—A versatile and consumable menu of winning styles in the dining market

Serving up great designs and delivering with superb logistics and a well-informed sales force are essential ingredients of the furniture trade. But, it goes without saying that market forces have a dominant place at the table. With an economic climate that has seen consumer spending take a downturn; closer examination shows that people are investing in the comfort and security of their homes. Yes, purse strings are tightened and if you were operating in the hospitality business it would be of serious concern, but for the furniture moguls, the fact that “in” is the new “out” presents a fabulous menu of opportunity.

A sentiment echoed by Andrew Cochrane, managing director at Nathan Furniture, who believes strongly that dining is definitely a growing area of the business. “With the current economic climate consumers are staying in more and entertaining at home is on the increase, which means more investment in formal dining furniture,” says Cochrane. “Only this week, one of the major supermarkets announced that sales of their ranges aimed at in-home entertainment had increased significantly.

“To meet this growing demand this year we have expanded our Shades teak range with the addition of a number of new models specifically for the dining room, all of which are proving very popular with stockists,” Cochrane explains. “The focus of our Shades dining models is flexibility. Tables have been specifically designed to extend; some have both a single and double extension and others a simple flip-top action that doubles the size of the table.”

A considerable heritage that is continually expanding, the Nathan brand has been in operation since 1916. Dining room collections have expanded significantly over the past four years and now contain Parisienne (a chic French-styled teak range launched this year), Shades (in teak), Copeland (in walnut).

Dining is embraced equally y TCH, a new company headed by Paul Duggan, the managing director cites experiences as the key to the future success of all the collections.

With three manufacturing factories and a head office in Lithuania, Duggan provides precise customer service and logistics locally through a UK office. Aimed at the mid to upper market, he is delighted to already have secured accounts with major high street names, such as House of Fraser. “We’re backing orders up with a guaranteed six to eight week delivery schedule. And once retailers have a selection on the floor, there’s an easy repeat process to fulfill customer orders,” he adds.

“Oak is a great wood,” Duggan comments. “As it is, I can see it will sustain for another few years and then it will appear in updated formats. We’ve got a plentiful, sustainable supply and we have plans for new finishes that will definitely keep consumers interested.”

Bentley Designs was established in 1988. Now an active supplier throughout the UK and Ireland, the company includes a team of designers and engineers to create inspirational designs that meet the ever-evolving style preferences of customers. The company’s manufacturing plants employ the most up-to-date automated finishing lines and processing machinery in order to ensure high standards of quality and workmanship.

The Cuba by Bentley Designs is part of the Gallery Collection. Bold and full of character, it combines fashionable style with the emphasis on good value. Choices across the range are wide; a slatted back chair with a faux leather pad, a fully upholstered chair in soft microfibre or a fixed or extending table. Prominently versatile, the range is available in three finishes.

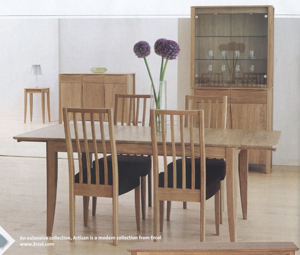

Ercol’s Artisan range is a comprehensive dining and cabinet range. It has been designed to a brief which, according to the outfit, meets the demands and flexibility required by modern life.

Designed by James Ryan, it combines the simple natural looks of solid oak with elegant styling details. Made using traditional methods at Ercol’s Buckinghamshire factory, the furniture features chamfered (shallow, angled cut) legs and table top edges, shaped integral drawer and door handles finished with clear matt wax for a contemporary look.

Dining chairs either have stick or upholstered backs and are available in a large choice of fabrics. Practical cabinetry offers a choice of two sizes of sideboards, display cabinets and a corner cabinet storage.

Just launched into the range, three new media units have been designed to accommodate wide screen televisions. “This is ideal for customers updating their television before the digital switch over,” says Nick Garratt, Ercol director, sales and operations.

“Artisan has become established as a core part of the Ercol dining collection,” continues Garratt. “Modern yet classic, it perfectly blends design with excellent functionality. It’s these elements that make it ideal for today’s living.”

“Design is a central part of Ercol,” says Garratt. “We have a hugely experienced in-house design team and we also commission designs from up-and-coming young British design talent. Through continual design and innovation we keep our ranges fresh and exciting and ensure they meet the needs of today.”

“Almost every piece of furniture is made to order. This is because we want every customer to get exactly the furniture they want and it to be individual to them. We offer up to six different wood finishes and over 100 fabrics, so the combinations are almost limitless,” Garratt emphasizes.

Run by husband and wife team Nick and Jackie Hartnack, Normadic Collections was founded in 2001.Based in rural Devon, the concern specializes in the design and wholesale of predominantly oak dining, as well as bedroom furniture.

“We believe in designing and producing good quality furniture that we would have in our home and would sell to our own friends and can proudly say is ours,” Nick Hartnack says. “We want our end-purchasers to feel the same, hence the company motto: ‘Furniture to be proud of’. We operate with excellent service, honesty and integrity.”

Totem Furniture was founded only a few years ago and in that time has managed to grow and develop into what has been a very competitive market. Managing Director Nick Lewer attributes success to a “can do” attitude from everyone in the company. “It’s about really going that extra mile to give customers the service they need. We all have a hand-on attitude,” says Lewer.

“My aim is to design and manufacture in different styles for the mid to top end of the market to offer the retailer the opportunity to make up orders with a mixture of models from with a mixture of models from different ranges for quicker deliveries,” he states.

The Lincoln collection from Caxton Furniture is aimed directly at the traditional end of the market, and its timeless appeal is allegedly proving a huge hit. The rich tones of the Cherry style finish combine with the traditionally inspired design. Features include antique brass-effect knobs with back plates and diamond cut glass in the cabinet doors.

The Ocaso collection from Winsor has been designed by owner Mark Devany. Established in 1987, it is now supplying a large number of high quality outlets throughout UK. Using the skills obtained while training as a cabinet maker, Devany produces a number of very distinct collections which he describes as transitional in style.

Neither traditional nor modern, Ocaso appeals to customers who want elegant designs with limited detail but with traditional quality in terms of construction and materials.

“All items are crafted from very high quality solid melia ash,” states Devany. “Traditional construction includes dovetailed drawers and solid tongue and groove back boards. The quality of the furniture and finish demands close inspection.

With the Setis collection, Gautier brings originality to basic furniture. Various units offer a very up-to-date style and finish to fit perfectly with other ranges.

Some of the pieces include: a round table beautifully created with a combination of steel and tempered glass which highlights its originality and its high decorative value; a coffee table (four finishes) with a unique aesthetic aspect that falls under a creative spirit and that offers more than a simple functionality (vast top and storage space); and a rectangular table which through a design of purified, elegant lines and equipped with two extensions (stored within) offers a great visual lightness and can accommodate 10-12 persons.

The introduction this year of a new Sepia finish brings an innovative, warm and contemporary touch.

Currently, there is increased importance for products to be related to the environment. Products more natural in their finish reinforced here by this stunning lacquer.

Part of Cane Industries (UK), Leeco has been in operation since the 1980s. Jonathan Lee explains: “We know about the market, customer service and good quality product.”

Specializing in occasional, conservatory and dining, the company is based near Warrington. With three dining collections in his portfolio, Lee designs the concepts himself; utilizing oak and tropical hard woods. A round dining table is made from environmentally friendly recycled teak. “It’s made from solid teak and 100% teak; there are no veneers or mixed wood construction,” Lee says.

“Aged and taken from old colonial buildings means that we have removed the need to cut down more trees,” he adds. “An extendible round dining table features a drop side table to make it small and compact if needed.”

Providing ample selections of choice, with a range of practical functions, the dining sector is one of the most vibrant sectors of the UL furniture trade. Keeping abreast of consumer demands and market trends will ensure consistent sales in this region. (Excerpted from the United Kingdom’s Cabinet Maker issued May 29, 2009)

Relax, Recline, Keep Moving—The versatile appeal of motion upholstery

With a multitude of redeeming features and excellent finishing, it is no wonder the world of motion upholstery can relax. With more consumers than ever demanding more from their living areas, recliners are now seen as a natural part of the fabric of the modern-day living space.

Suited to all age groups and catering for a wide variety of decor preferences, motion upholstery is a recurrent—and persistent—winner for the market.

Stressless is a well-known name in the UK recliner market. The brand (manufactured by Ekornes in Norway) has blossomed from offering just recliner and footstools to presenting the complete look in the living room. The outfit, which is celebrating its 75th birthday this year, has sold a staggering five million recliners worldwide.

Stressless also offers reclining chairs and sofas, with both a contemporary and traditional feel to the overall look. Although primarily concerned with comfort, in more recent times it has also succeeded in the style stakes with models that also appeal to contemporary living. Jazz and Blues recliners, for instance, were launched in he last tow years. Reported as slick, aspirational ‘crowd pleasers’, the range holds the allusive appeal of being a great window dresser.

The company’s recliners offer head and back support second to none, the chairs can swivel 360 degrees and can be fully reclined. A mark of its enduring appeal is the Stressless Royal recliner model now in its 25th year. Its classic design has stood the test of time with the odd ‘tweak’ in recent years to keep it relevant to today’s customers.

Stressless was a pioneer of the home cinema furniture concept. Now offering several models that work perfectly in this arena, it has also refined the footstools with all new models offering an additional tilt mechanism for bonus comfort relaxation. Attention to detail has always been key to the brand’s success and today it offers a number of wood and metal trims and shapes for its furniture.

In the last couple of years, Stressless has introduced four plain fabric ranges, in response to potential customers who wanted Stressless products in fabric, as opposed to the 40 plus leather colorway options.

Sherborne Upholstery believes strongly in communication with its customer base. Chris Fort, chairman and managing director, says: “We know from feedback from suppliers that we are extremely busy! Sales continue to come in significantly above last year’s level and we are very pleased indeed to be ‘bucking the trend’ in this way.

To assist the retailer, Sherborne recently changed many of its reclining two-seater settees so that they can all now be delivered in two sections into the home. “They all have removable backs too, to make it even easier, as do the reclining ends of three-seaters which were already supplied in this modular form,” Fort advises.

“Our Lynton and Lisbon compact ranges also continue to sell well, as do all of our full-sized recliners and suites. The introduction of our book three fabrics swatch of upmarket semi-plain Dralon chenilles in fourteen different colorways has undoubtedly increased the appeal of all our soft cover ranges,” he indicates.

In addition, a comprehensive range of electric ‘lift and rise’ recliners, are all available with a choice of one or two motors. “All soft covers are available at the same on express delivery and for the majority of the range; all leathers are also offered on the express service,” Fort adds.

Versatility, service and choice are therefore key components to the market and the importance of these facilities appears to be part and parcel of the high caliber of this market segment.

Another company known for superb quality and service is Ercol. The Gina recliner model offers exceptional comfort, both in the sitting and reclining positions. Elegantly designed it has an attractive solid ash show wood frame that rotates on a five star solid wood base.

The unique design of the reclining mechanism allows synchronous movement between the seat and the backrest which creates a natural angle between the upper and lower body keeping the seat at virtually the same height while the back reclines—for complete comfort.

Gina comes in two width sizes and with the option of a manual or an electric action. Presented in six wood finishes and a wide choice of fabrics, it is also available in a number of leather colors.

Established for 25 years, Furnico is delighted to discuss their recent new additions to the range of motion upholstery. Sales director, Darren Hargreaves, comments: “We now have the UK license for Berkline Action.,” he says. “This is a fantastic motion manufacturer. We also sell models with manual and power options.”

Single seaters, two and three seaters are available from the wide range of both fabric and leather styles. However, as well as a huge choice to offer retailers, Hargreaves comments that it is practical selling points that make all the difference too. “We incorporate special features which mean that children will never get fingers caught in mechanism,” he says.

Since taking over the La-z-boy UK (LZB) license in September 2008 things have changed considerably according to David Winter.

“LZB have completely changed the range with a very successful range change launched at NEC 09,” says Winter. “The new fabrics and leathers bring a fresh new life to the UK range,” he states.

“Pulling all aspects together for an entire new range has been very hard but very rewarding work, retailers reactions endorse my belief that the new ‘La-z-boy Comfort Studio Range’ is a winner,” Winter adds. “Retailers often comment that their consumers actually ask for the LZB brand by name and simply will not settle for anything less.”

“The LZB brand is much loved by the retailers and much more importantly the end consumer recognizes LZB as a world beating reclining furniture brand,” he concludes.

A talent for versatility and a strength in design, motion upholstery it is no surprise that motion upholstery continues to be a flexible and reliable staple of the retail floor. (Excerpted from the United Kingdom’s Cabinet Maker issued June 5, 2009)

Imports Fall 6% in 2008

U.S. furniture imports declined 6% in 2008 amid a global financial crisis that caused many U.S. consumers to spend less.

Figures compiled by Furniture/Today’s market research department showed that indoor residential furniture shipments to the United States fell 6% to US$22.6 billion in 2008 from US$24 billion the previous year. The drop is the first recorded in more than a decade, since Furniture/Today has been compiling the data.

The decrease is not as dramatic as the estimated 12.3% drop in shipments among domestic furniture producers reported by accounting and consulting firm Smith Leonard, which includes some imports that flow trough U.S. plants.

Still, it showed that many consumers were reluctant to buy even lower-priced imports as they grew more concerned about job security and shrinking retirement portfolios.

The analysis covers products ranging from wooden bedroom and dining room furniture to mattresses, chairs and chair frames.

China remained the largest overseas source, even though the value of its imports fell 6% to US$12.2 billion. Canada remained a distant No. 2 as its U.S. shipments declined 14% to US$1.9 billion.

Vietnam solidified its grip on the No. 3 spot as its shipments climbed 19% to US$1.4 billion. The only other countries whose U.S. imports grew were Taiwan, whose 10% jump placed it at No. 7, and Germany, which edged up 1% and was No. 9.

Mexico remained the fourth largest foreign source despite a 9% decline in shipments to just over US$1 billion, followed by Italy with US$830.4 million (down 14%) and Malaysia with US$696 million (down 9%).

Thailand garnered the No. 10 spot with US$252 million in 2008 shipments, down 22%. Meanwhile, Brazil’s shipments fell 32% to US$164.5 million, dropping it three spots to No. 13.

Not all Chinese manufacturers saw U.S. sales declines last year. Bedding and case goods manufacturer Stylution’s sales here were up 32%, said company CEO Jack Chen. He said that employment at the company’s 1 million square feet of production and warehouse facilities in the Dongguan area of southern China rose by 140 last year to 1,240. This March, the company hired another 400, said Chen.

Despite its success in the U.S. market, he said that like other Chinese sources, Stylution is still facing higher raw material and labor costs. “Our biggest challenge is to keep our cost down but our quality high,” Chen said. “We want to be more efficient and be able to react to these changing times. We cannot be stuck in old thinking or habits from the past, and must always look to the future and have the willingness and ability to react fast and change with the market.”

With Canada and China, wood furniture shipments experienced the largest declines. Meanwhile, Vietnam and Indonesia saw higher shipments of products such as wooden bedroom furniture, probably at least partly because buyers were seeking alternatives to Chinese-made wood bedrooms, which still carry antidumping duties.

Germany also increased its wood furniture shipments to the U.S., while Taiwan’s business was driven by its still-vibrant metal furniture and components industry. (Excerpted from Furniture/ Today issued May 18, 2009, vol. 33, No. 36)

Top 25 Sales Drop 10.4%

Sales of the top 25 furniture sources for the U.S. market declined an estimated 10.4% in 2008 as business slowed to a crawl in the fourth quarter of the year, according to Furniture/Today market research.

Volume for the largest manufacturers and importers has now fallen for two years in a row—the first time that’s happened since we began tracking the top 25 in 1989. The estimated decline in 2007 was 6.5%.

Twenty-one of the companies in the ranking had lower sales in 2008 while four were up. Leading the gainers was Natuzzi, the publicly held Italian upholstery giant that had estimated U.S. furniture sales of US$311.5 million, a 6.8% increase from 2007. Another gainer was Lexington Home Brands. The full-line resource was estimated to post at 2.4% increase in U.S. furniture sales, doing well enough in the first three quarters to stay above water as business slowed late in the year.

A pair of ready-to-assemble furniture suppliers, Sauder Woodworking and Dore Inds., also crept upwards with sales gains of 1.7% and 2.8%, respectively. “We had some strong growth with the discount stores—Wal-Mart and Target in particular—and that seems to be where people are shopping,” said Kevin Sauder, president of Sauder Woodworking, the largest U.S. RTA supplier and the fifth-largest furniture source overall.

He also said that the switch to new consumer electronics, primarily flat-panel televisions and laptop computers, has created a surge in demand for smaller furniture—consoles to hold the flat TVs rather than armoire or wall-style entertainment enters, and desks sized for laptops rather than desktop computers.

A dozen of the top 25 are publicly held and report their earnings. Collectively, this group posted a net loss of about US$421 million in 2008, compared with collective earnings of US$47 million the year before.

Most of the losses were due to the AIR—asset impairment and restructuring charges, which blossomed last year as companies wrote down the book value of assets including goodwill (such as brand names or other intangibles), inventory, plants that were closing, and deferred tax assets.

Six of the 12 publicly held companies reported losses, up from five in 2007, and the losses generally were larger. (Excerpted from Furniture Today issued May 18, 2009, Vol. 33, No. 36)

Online Furniture Retailers Continue to Make Inroads

Online retail sales, excluding travel, event tickets and digital downloads, totaled US$132.4 billion in 2008, according to the U.S. Department of Commerce. And a recent estimate from comScore pegs the furniture category at about 3.5% of all e-commerce retail sales. That means online furniture sales totaled approximately US$4.6 billion last year, or about 6% of total consumer spending for furniture and bedding.

The online channel is not immune to the recession, though. According to the U.S. Department of Commerce, online retail spending in the first quarter of 2009 was US$31.7 billion, down 5.4% from US$33.5 billion in the first quarter of 2008. eMarketer recently forecasted online spending to rebound in 2010 and hit a projected US$163.9 billion by the end of 2011.

There’s no doubt that the face of retailing in the United States has changed dramatically. While there were about 1.1 million brick-and-mortar stores operating at the beginning of 2008, according to the Bureau of Labor Statistics, 148,000 of them closed during the year. That was on top of the 135,000 retail stores that closed during 2007. And the International Council of Shopping Centers projects another 150,000 stores will close in the United States this year. This reality has presented online retailers with opportunities to grab consumers wanting to buy.

The 20 online-only home furnishings retailers highlighted in this report alone sold about US$1 billion worth of furniture during 2008. Online-only furniture giants include Boston-based CSN Stores and Omaha, Neb.-based Netshops. These retailers both operate more than 200 niches storefronts, each focusing on a product category. While many product categories have more than one storefront, behind each is a corporate support system that fulfills all marketing and customer service functions.

Take the home office category as an example. CSN features WritingDesksandMore.com in its arsenal, and NetShops operates WritingDesks.com. Both companies realize online consumers are not likely to type CSNStores.com or NetShops.com into their web browser. Instead, online shoppers go to Google or another search engine and look for a “desk”.

The online channel is far from mature. CSNStores CEO Niraj Shah is “seeing a lot of marginal players go away and consolidation starting to occur.” Shah believes that e-tailers who provide the best selection, service and competitive prices “will continue to flourish and gain increased traction.” In an effort to solidify its position, CSNStores has been “spending a tremendous amount on new technology on both infrastructure and user features,” Shah says. While some of the technology has already rolled out, most is slated to go live during the third quarter of this year.

Previous research has estimated that between 70% and 80% of U.S. adults have purchased something online. And according to Furniture/Today and HGTV’s 2009 Consumer Views Survey, 44% of adult U.S. consumers have purchased home furnishings online. Occasional tables, entertainment furniture and youth furniture are the leading furniture categories purchased online, followed by desks and master bedroom. Home accents, such as wall decor and area rugs, have higher purchase rates through the Web.

The exclusive consumer data shows that Generation X—currently between the ages of 34 and 44, numbering 44.5 million or 16% of the U.S. population—is the No. 1 generation purchasing furniture online. And higher-incomes of US$100,000 or more, are more likely than lower-income groups to purchase furniture through the Internet. (Excerpted from Furniture/ Today issued July 20, 2009, Vol. 33, No. 44)