Office Furniture Parts: Legs, Castors, MechanismsKeeping Ahead of the Competition Through Innovation

May 20, 2005 Ι Supplier News Ι Furniture Ι By Philip Liu, CENS

With the continuation of the global rise in prices of raw materials such as iron and steel over the past year and more, Taiwan's makers of office-furniture parts are seeking to boost the added value of their products in an effort to overcome the higher materials costs. Fortunately, with more than three decades of development behind them, manufacturers in the line have the ability to design and produce state-of-the-art innovative products.

Some suppliers report that they are using a wide variety of metals, including stainless steel, aluminum alloy, and iron, to make self-designed parts for office furniture. This is necessary, they explain, because they need a sophisticated design capability so that they can attract more original design manufacturer (ODM) orders instead of relying on the traditional, low-profit original equipment manufacturer (OEM) sales.

Up with Innovation, Down with Costs

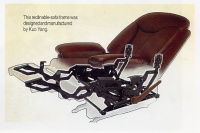

Kuo Yang Metallic Co., Ltd. A relative newcomer to the line with headquarters in Taiwan, set up two production facilities in mainland China a decade ago to turn out metal scaffolding for the construction industry. It became involved in office furniture only in August last year, when it began making chair handles and legs. This year it expanded its product line to include office automation (OA) chair-seat bases, swivel bases with bearings, and reclinable-sofa frames.

Jeff Huang, the company's president, claims that his experience in making scaffolding provided a good foundation for entry into furniture parts. "We've succeeded in cultivating expertise in making molds suited to metal-furniture parts, " he explains.

Known for its strong R&D department, Kuo Yang reports a surge in ODM orders over the past few months-because, Huang says, "We're capable of designing sophisticated products to meet the needs of customers all over the world."

The company uses sophisticated production equipment to ensure quality, including screw heading machines, cold-forged-parts forming machines, thread rolling/threading/straightening machines, carbon-dioxide welding machines, electric welding machines, spot-welding machines, butt-welding machines, TIG welding machines, metal-cutting machines, drilling machines, and enameling and spray-coating equipment. Some of these machines have a punching capacity of 300 tons.

"Ever since our establishment we've concentrated on developing innovative products while minimizing production costs so that we can offer high-end products at reasonable prices, " Huang comments. "In addition to quality, we also pay a lot of attention to the creation of a comfortable working environment to help our workers boost productivity. And our operation complies with ISO standards."

The company currently sells 30% of its output on mainland China's domestic market. "By the end of this year, " Huang says, "we'll raise our export ratio to more than 50%, because we've been seeing an influx of orders from the industrialized nations since the end of last year and we expect the growth to continue throughout 2005."

Avoiding Mass Production

Another leader in the line is Ho Yuh Tai Industry Corp., set up 17 years ago to make metal parts for bicycles and later on became involved in medical equipment and sporting goods, which specializes in making electroplated metal parts and accessories for furniture.

The company uses stainless-steel, aluminum-alloy, and iron tubes, all procured in Taiwan, to make its furniture parts. The company claims an ability to pinpoint high-end materials needed to manufacture high-quality products.

While maintaining the production of parts for the bicycle, medical equipment, and sporting goods industries, Ho Yuh Tai is trying hard to raise the ratio of furniture parts in its product mix. The ratio is already on the increase, rising from 21% last year to 25% now in terms of production value.

"Most of the manufacturers in Taiwan are small and medium in size, " notes the company's president, Chang Chi-lieh, "and they should develop a diverse product line to bring in more customers while reducing operating risk at the same time. That can prevent them from being squeezed by a single large customer."

For his own company, Chang goes on, "Only by the production of high-end products can we differentiate our products from those made in developing countries. That's why we're keeping ourselves firmly in Taiwan instead of moving production to mainland China, like some of our domestic rivals have done."

Chang say that he wants to develop a small-batch, large-variety mode of production instead of going for mass-volume manufacturing. "The large-volume mode is suitable for manufacturers in developing nations such as mainland China, " he explains, "but our production relies on specific designs that are very different from each other. Most of our products are developed to accommodate the shapes of bent wood or other materials, so our production relies heavily on skilled workers that mainland Chinese manufacturers cannot afford."

Chang notes that metal-furniture parts and accessories usually have more varied designs than those used in bicycles, sporting goods, and medical equipment, and asserts that "By way of the production process, we can enhance the functions of our products to make them suitable for use in functional furniture. And by using three-dimensional software, we can turn out products that our customers order even if all they provide us are graphics through the Internet."

Ho Yuh Tai currently exports more than 70% of its total output, mostly to metal-furniture makers in Europe and Japan.

Expertise Flowing From Experience

Tung Tien Enterprise Co. has been making casters for furniture, luggage, medical instruments, shopping carts, industrial equipment, and other products for more than a quarter of a century. Its integrated production lines at two separate plants in Changhua County, central Taiwan are able to handle all manufacturing processes for casters, from design, stamping, and plastic-injection molding to finishing and packaging.

The company constantly invests in new manufacturing technologies and product development, giving its casters ever-higher loading capacities. These products account for 95% of the company's current production.

Tung Tien offers four types of casters: ball, light, heavy, and medical-instrument. The ball and light casters have a maximum loading capacity of 50 kilograms, while the medical-instrument casters can bear loads of 100kg and the heavy casters can handle 150kg to 300kg.

President Liang Ming-tung claims that the company has produced more than 1, 000 models of casters with different specifications so far. Its R&D department is able to introduce several new items every quarter of the year.

Its vast experience has given the company considerable expertise in making high-end casters, all of which have to pass a strict durability inspection before they are delivered. As a result, Liang says, "Our casters maintain their original quality in testing through over 38, 000 cycles of continuous load moving."

The key to this durability, he says, is the location of the support point. And this, he goes on, "is something that we've become proficient in locating, thanks to our long experience in the line." By handling all processes in-house, the company is also able to maintain strict quality control.

Its high quality has enabled Tung Tien to expand its overseas sales steadily in recent years, which prompted the opening of the company's second factory less than three years ago. Its workers can currently turn out 50, 000 casters per day in two shifts. The casters are exported on an original brand manufacturer (OBM) basis, mostly to buyers in Japan, the U.S., Europe, mainland China, Southeast Asia, and the Middle East.

In the past overseas sales were handled by trading houses, but a few years ago the company set up its own marketing department to handle such sales directly.

Another New Kid in Town

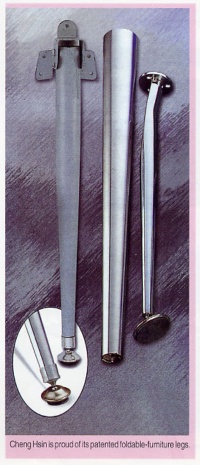

Another supplier that came into furniture parts from a different field is Cheng Hsin Iron Works Factory, established in 1968 to turn out auto parts, hydraulic production equipment, and molds and dies. Over the past three years it has added metal-pipe furniture parts and accessories (metal-furniture legs and feet, as well as metal and plastic pads) to its line of products.

"By making and exporting hydraulic equipment, " says the firm's president, Hsieh Yi-chih, "we've accumulated the experience we need to make deep-drawing iron and stainless-steel products for the furniture, bathroom, and sanitary products industries. We've also gained much expertise in designing molds for furniture, and over the past several years we've been commissioned by numerous foreign clients to design molds."

The company is proud of its foldable metal-furniture legs (patented in Taiwan and mainland China) for casual tables, sofas, cabinets, and Japanese-style tables. Innovative products are developed by Cheng Hsin's own R&D department; among its recent successes, the department came up with lightweight laser suckers used on tables with glass tops.

Half of the company's total production (most of which is either electroplated or enamel-baked) is exported, mainly to the U.S. and Western Europe.

In the face of the global economic slowdown, Cheng Hsin nevertheless chalked up annual growth rates of 25% to 40% during the past three years. Similar growth is expected in 2005. (Mar. 2005)

Some suppliers report that they are using a wide variety of metals, including stainless steel, aluminum alloy, and iron, to make self-designed parts for office furniture. This is necessary, they explain, because they need a sophisticated design capability so that they can attract more original design manufacturer (ODM) orders instead of relying on the traditional, low-profit original equipment manufacturer (OEM) sales.

Up with Innovation, Down with Costs

Kuo Yang Metallic Co., Ltd. A relative newcomer to the line with headquarters in Taiwan, set up two production facilities in mainland China a decade ago to turn out metal scaffolding for the construction industry. It became involved in office furniture only in August last year, when it began making chair handles and legs. This year it expanded its product line to include office automation (OA) chair-seat bases, swivel bases with bearings, and reclinable-sofa frames.

Jeff Huang, the company's president, claims that his experience in making scaffolding provided a good foundation for entry into furniture parts. "We've succeeded in cultivating expertise in making molds suited to metal-furniture parts, " he explains.

Known for its strong R&D department, Kuo Yang reports a surge in ODM orders over the past few months-because, Huang says, "We're capable of designing sophisticated products to meet the needs of customers all over the world."

The company uses sophisticated production equipment to ensure quality, including screw heading machines, cold-forged-parts forming machines, thread rolling/threading/straightening machines, carbon-dioxide welding machines, electric welding machines, spot-welding machines, butt-welding machines, TIG welding machines, metal-cutting machines, drilling machines, and enameling and spray-coating equipment. Some of these machines have a punching capacity of 300 tons.

"Ever since our establishment we've concentrated on developing innovative products while minimizing production costs so that we can offer high-end products at reasonable prices, " Huang comments. "In addition to quality, we also pay a lot of attention to the creation of a comfortable working environment to help our workers boost productivity. And our operation complies with ISO standards."

The company currently sells 30% of its output on mainland China's domestic market. "By the end of this year, " Huang says, "we'll raise our export ratio to more than 50%, because we've been seeing an influx of orders from the industrialized nations since the end of last year and we expect the growth to continue throughout 2005."

Avoiding Mass Production

Another leader in the line is Ho Yuh Tai Industry Corp., set up 17 years ago to make metal parts for bicycles and later on became involved in medical equipment and sporting goods, which specializes in making electroplated metal parts and accessories for furniture.

The company uses stainless-steel, aluminum-alloy, and iron tubes, all procured in Taiwan, to make its furniture parts. The company claims an ability to pinpoint high-end materials needed to manufacture high-quality products.

While maintaining the production of parts for the bicycle, medical equipment, and sporting goods industries, Ho Yuh Tai is trying hard to raise the ratio of furniture parts in its product mix. The ratio is already on the increase, rising from 21% last year to 25% now in terms of production value.

"Most of the manufacturers in Taiwan are small and medium in size, " notes the company's president, Chang Chi-lieh, "and they should develop a diverse product line to bring in more customers while reducing operating risk at the same time. That can prevent them from being squeezed by a single large customer."

For his own company, Chang goes on, "Only by the production of high-end products can we differentiate our products from those made in developing countries. That's why we're keeping ourselves firmly in Taiwan instead of moving production to mainland China, like some of our domestic rivals have done."

Chang say that he wants to develop a small-batch, large-variety mode of production instead of going for mass-volume manufacturing. "The large-volume mode is suitable for manufacturers in developing nations such as mainland China, " he explains, "but our production relies on specific designs that are very different from each other. Most of our products are developed to accommodate the shapes of bent wood or other materials, so our production relies heavily on skilled workers that mainland Chinese manufacturers cannot afford."

Chang notes that metal-furniture parts and accessories usually have more varied designs than those used in bicycles, sporting goods, and medical equipment, and asserts that "By way of the production process, we can enhance the functions of our products to make them suitable for use in functional furniture. And by using three-dimensional software, we can turn out products that our customers order even if all they provide us are graphics through the Internet."

Ho Yuh Tai currently exports more than 70% of its total output, mostly to metal-furniture makers in Europe and Japan.

Expertise Flowing From Experience

Tung Tien Enterprise Co. has been making casters for furniture, luggage, medical instruments, shopping carts, industrial equipment, and other products for more than a quarter of a century. Its integrated production lines at two separate plants in Changhua County, central Taiwan are able to handle all manufacturing processes for casters, from design, stamping, and plastic-injection molding to finishing and packaging.

The company constantly invests in new manufacturing technologies and product development, giving its casters ever-higher loading capacities. These products account for 95% of the company's current production.

Tung Tien offers four types of casters: ball, light, heavy, and medical-instrument. The ball and light casters have a maximum loading capacity of 50 kilograms, while the medical-instrument casters can bear loads of 100kg and the heavy casters can handle 150kg to 300kg.

President Liang Ming-tung claims that the company has produced more than 1, 000 models of casters with different specifications so far. Its R&D department is able to introduce several new items every quarter of the year.

Its vast experience has given the company considerable expertise in making high-end casters, all of which have to pass a strict durability inspection before they are delivered. As a result, Liang says, "Our casters maintain their original quality in testing through over 38, 000 cycles of continuous load moving."

The key to this durability, he says, is the location of the support point. And this, he goes on, "is something that we've become proficient in locating, thanks to our long experience in the line." By handling all processes in-house, the company is also able to maintain strict quality control.

Its high quality has enabled Tung Tien to expand its overseas sales steadily in recent years, which prompted the opening of the company's second factory less than three years ago. Its workers can currently turn out 50, 000 casters per day in two shifts. The casters are exported on an original brand manufacturer (OBM) basis, mostly to buyers in Japan, the U.S., Europe, mainland China, Southeast Asia, and the Middle East.

In the past overseas sales were handled by trading houses, but a few years ago the company set up its own marketing department to handle such sales directly.

Another New Kid in Town

Another supplier that came into furniture parts from a different field is Cheng Hsin Iron Works Factory, established in 1968 to turn out auto parts, hydraulic production equipment, and molds and dies. Over the past three years it has added metal-pipe furniture parts and accessories (metal-furniture legs and feet, as well as metal and plastic pads) to its line of products.

"By making and exporting hydraulic equipment, " says the firm's president, Hsieh Yi-chih, "we've accumulated the experience we need to make deep-drawing iron and stainless-steel products for the furniture, bathroom, and sanitary products industries. We've also gained much expertise in designing molds for furniture, and over the past several years we've been commissioned by numerous foreign clients to design molds."

The company is proud of its foldable metal-furniture legs (patented in Taiwan and mainland China) for casual tables, sofas, cabinets, and Japanese-style tables. Innovative products are developed by Cheng Hsin's own R&D department; among its recent successes, the department came up with lightweight laser suckers used on tables with glass tops.

Half of the company's total production (most of which is either electroplated or enamel-baked) is exported, mainly to the U.S. and Western Europe.

In the face of the global economic slowdown, Cheng Hsin nevertheless chalked up annual growth rates of 25% to 40% during the past three years. Similar growth is expected in 2005. (Mar. 2005)

©1995-2006 Copyright China Economic News Service All Rights Reserved.