Taiwanese Suppliers Stress Heat Dissipation, Ergonomics

Mar 26, 2004 Ι Industry News Ι Furniture Ι By Ken, CENS

Rare is the office worker that enjoys sitting all day long in a chair with poor heat-dissipation performance and is not ergonomic. This straightforward reality is of course directly related to the popularity of an office-chair supplier's sales and profits, and makers thus unceasingly seek model improvements.

These come in two areas. In recent years, various Taiwanese office-chair manufacturers and materials suppliers have teamed up to co-develop materials that have demonstrated superior heat dissipation. Some feature the most advanced nano-tech materials. Design specialists have also made impressive progress in making chairs more ergonomic.

These efforts are not just driven by customers' needs, but also by chair suppliers' attempts to transform themselves from pure manufacturers into value-adding designers as well so that they can shake off intensifying price-undercutting competition , notably from low-cost suppliers in mainland China and some Southeast Asian nations, in the original equipment manufacturing (OEM) market.

One of a Kind

The experience of Isotech Products Inc. in many ways serves as a case study in materials improvement. The company is part of the 25-year-old Isotech Group, and is dedicated to the development and production of polyester-based synthetic materials. Three years ago, Isotech Products and its parent company successfully co-developed a type of sponge that features both superb air penetration and heat dissipation.

Founded in 1985, the firm supplies its proprietary "More Sorb" material to many leading Taiwanese suppliers of office chairs, and also to the world's No. 1 contract supplier of sports shoes, the Pou Chen Group, for use as shoe cushions. The material was originally designed for medical purposes. "We are awaiting the government' s GMP (Good Manufacturing Practices) certification to enable us to sell to the medical-item industry, but can already sell to manufacturers of non-medical products," explains H.B. Lee, company general manager. "We are expecting approval shortly."

Lee's company has done extensive testing on this material under many applications, with strongly positive results. The temperature on the surface of the "More Sorb" chair seat after normal usage of approximately 30 minutes is about 0.5 to 0.8 Celsius degrees lower than that on the surface of standard chairs. In addition, lab tests prove that the material, when used as a bandaging material for medical use, performs very well in wound-healing, with good air penetration. Best of all, says Lee, "More Sorb" has been recognized as a non-toxic material by the U.S. Federal Drug Administration, and the company received a citation recognizing the innovative material at the REHACare International 2003 medication trade show in Germany.

"More Sorb" comes in two types--a quick-rebound VF version for shoes and a slow-rebound UF version for furniture pieces.

"'I can tell you that 'More Sorb' is absolutely a tremendous improvement in cushion materials for furniture--an area where the technology had not progressed much over a long period," Lee says. He attributes the company's accomplishment primarily to its strong R&D team of seven specialists, led by a vice president with a Ph.D. in materials science from the United States who served in heavyweight chemical-technology companies such as Bayer and DuPont for a combined 20-some years in the States.

"More Sorb" is by no means the company's first material designed for furniture use. The company has also developed PU and PV materials for chair seats, armrests, and chair backs. "Compared with PU and PV, however, 'More Sorb' is a much more effective furniture material," Lee emphasizes.

Some German furniture suppliers, Lee reports, have shown interest in procuring the "More Sorb" technology, and a number of South Korean manufacturers have placed orders. His company also hopes to co-produce the material with international furniture suppliers in promising markets. "At home, we hope our material can help furniture manufacturers develop high-end pieces so they may differentiate themselves from makers in the low end and mid-range, where overcrowding has led to intense price-cutting," Lee comments.

With the material now part of the company's product line, Lee expects his company's sales to increase sharply in 2004, from last year's NT$500 million (US$14.7 million at US$1:NT$34).

Chair-iots for the Office Warrior

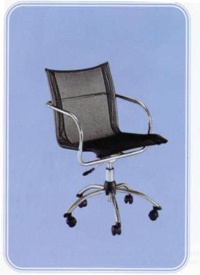

Chin Huang Hsin Co., Ltd.'s N102AG office chairs have seats and backs outfitted with synthetic-fiber netting, effectively addressing the need for air-penetration. The company introduced the line around one year ago.

"These chairs enable sitters to remain much more comfortable than do sponge chairs," states company chairman Mike Lin. Each has a maximum load capacity of 200 kilograms, with the maximum force-resistance of the fiber netting one ton.

Thanks to a recent large-volume order from an American buyer, the company has been turning out 60,000 of the chairs a month from February, triple the original 20,000 in previous months which accounted for one-fifth of its total output.

Lin says the color of the chairs--black--is particularly attractive to European and American consumers. "Taiwanese and Japanese consumers prefer light colors," he notes.

The N106AG design was, like the company's other models, done in-house. The chairs have sponge cushions in the seat and back, as most office chairs do, but are equipped with a T-shaped metal frame as the support for the seat upholstery, instead of the standard metal or wood board. According to Lin, the T-shape frame design is based on mechanical dynamics, which enables it to pillar the seat at major weight points and esults in savings on materials costs.

Another unique design is that the chair has a plastic cover which gives the chair a smooth look by concealing the T-shape frame inside the seat from the underside. On the back-side edge of the covering is a button used to adjust the height of the chair. On standard chairs, an adjustment handlebar is most common.

The N106AG's armrests are also adjustable. The space between one rest and the other can be widened to 700 mm, from the standard 500 mm, by simply pressing and releasing a control button on the plastic cover.

Lin points out that his company began introducing ODM-based products two years ago. "Competition in the OEM market has become ever more intense with more and more low-cost, price-undercutting mainland Chinese and Vietnamese rivals jumping into the market," Lin explains. However, he states that promotion of the more profitable ODM-based wares is not an easy job, with attractive exterior appearance crucial.

Fortunately, the competitive threat has intensified the links between Lin's company and its supporting partners, with the latter agreeing to cut their charges so that his company can lure back orders with more competitive quotes, leading to a virtuous circle with more contracts in return.

Like many other Taiwanese office-furniture suppliers, Lin's company has begun contracting Taiwanese manufacturers operating in mainland China to supply it parts, with the company assembling and exporting from Taiwan to cut costs. The parts are made of a variety of materials, but not wood. Lin says that his company has stopped using wood boards, at least for the foreseeable future, to make its products as different from the average manufacturers' as possible. "Currently, most still equip their chairs with wood boards to support the seat upholstery," he notes.

To deal with the heat-dissipation problem, Chuen Lei Enterprise Co., Ltd. Plans to roll out chairs coming with nanometer upholstery in the second half of this year. "We have worked on this material in cooperation with a materials supplier for a while, successfully overcoming all difficulties regarding their application to chair seats," says company president C.J. Lai.

The company will also present chairs furnished with PVC seats to cater to Japanese consumers, and chairs designed in cooperation with ergonomics specialists. The ergonomic chairs will feature a back that can be tilted backward at many angles.

His company launched its OEM operations around three years ago. "In the OEM market, it's not you but buyers who determine trade prices. But in the ODM market, you decide the prices and profit margins," Lai states, adding that he has seen many Taiwanese OEM-based manufacturers fall at the feet of the competition. To boost its ODM strength, Chuen Lei has worked on new designs with several brand-name furniture suppliers in the United States (Colovos), Europe, and Japan.

Lai's company is not always on the defensive in terms of price-undercutting, he says. Chuan Lei will soon be able to churn out products that are much cheaper than those produced by mainland Chinese suppliers, without compromising the quality. The firm has teamed up with parts suppliers to invest in integrated production lines. Three years ago, Lai's company opened a 30,000-ping factory at an investment of around NT$300 million (US$8.8 million at US$1:NT$34) in mainland China, in tandem with 20-some parts and material suppliers. "We have since the beginning of this year pursued the goal of developing and making all parts in-house, to better control costs, quality, and the technology used."

Lai projects the mainland Chinese factory will have revenue of NT$2 billion (US$59 million) this year, rising from last year's NT$1.2 billion (US$35 million). The Taiwan headquarters will post revenue of NT$200 million (US$5.8 million), also representing an increase.

Another advantage for Taiwanese furniture suppliers shifting to original equipment manufacturing and own-brand identification are the recent anti-dumping measures the U.S. government and the European Union have slapped on mainland China-made furniture, Lai states. "The action mostly addresses unacceptably low-priced OEM-based wares. So, I feel ODM-based and own-brand products will have ample room in the market this year."

The Chuen Lei chairman points out that the primary disadvantage for Taiwanese furniture suppliers is the still higher cost of materials, which have eaten into profits. Nevertheless, he is confident that his company's close cooperation with materials and parts suppliers will help significantly cut his company's costs.

Sun Shining on This Firm

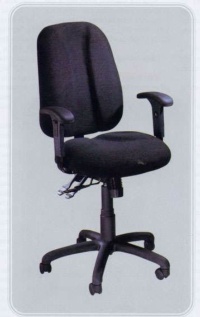

Henn Sun Co., Ltd. Has emphasized more on looks of its chairs than on heat-dissipation solution. As an ODM since establishment six years ago, the company has counted on its designs. Recently, the company rolled out its second collection of self-designed chairs, the HS-2036 family.

The new chairs are equipped with forged aluminum lumbar-support bars. The slim curve of the bars, according to company owner Jeff Lo, is his idea based on the elegant curve of goblets. Good look has won the bar patents in the United States, Taiwan and mainland China. Lo notes that aluminum is lighter and more durable than steel. Also, forging aluminum is a process much more complicated and costly as compared with pressing steel. "When it comes to process related to forging, it must be done with molds. Building molds usually costs a big money," Lo stresses. He spent around NT$6 million (US$176,500) on the bar molds.

All the spending is close to paid-off as some big office-furniture suppliers on the island and overseas have been talking orders for the chairs.

Lo's first patented chair was its future-look NL-1 family of chairs. This family is equipped with a streamlined one-piece back, making it look like chairs on the Enterprise space ship in the movie Star Trek. This chair also cost Lo huge money on molds. However, it also won his company considerable orders.

Lo himself is an idealist, who has been pursuing the goal of designing a chair that is suitable for everyone. "So, you can see my designs all come from scratch, basing on no precedents," he reports. What makes him feel regretful is that his company cannot afford too many new designs every year because of limited financial capability. "So, I can choose only a few ideas for my new designs and this increases operation risk if none of them is marketable," he laments. Fortunately, his NL-1 and HS-2036 families are popular.

Even though Lo has been diligently collecting market information through important trade shows in order to keep his products trendy, he still feels great pressure as fundamental changes come ever more quickly. "Buyers from different markets around the world may not buy your attractive products at first sight, continually contacting you to discuss their needs in relation to your designs. But if you stop offering new designs, they will stop visiting you for sure," he notes.

Over the past few years, Lo's business has increased at an acceptable pace, while many of his industrial peers at home have complained of limited returns because of the global recession. He attributes his company's moderate but steady growth mostly to its superior design work.

The company's designs, Lo says, mostly target European consumers, avoiding competition with low-price manufacturers focusing on the vast U.S. market. The company contracts only one dealer in each marketplace so that in-fighting for market share among dealers can be avoided.

These come in two areas. In recent years, various Taiwanese office-chair manufacturers and materials suppliers have teamed up to co-develop materials that have demonstrated superior heat dissipation. Some feature the most advanced nano-tech materials. Design specialists have also made impressive progress in making chairs more ergonomic.

These efforts are not just driven by customers' needs, but also by chair suppliers' attempts to transform themselves from pure manufacturers into value-adding designers as well so that they can shake off intensifying price-undercutting competition , notably from low-cost suppliers in mainland China and some Southeast Asian nations, in the original equipment manufacturing (OEM) market.

One of a Kind

The experience of Isotech Products Inc. in many ways serves as a case study in materials improvement. The company is part of the 25-year-old Isotech Group, and is dedicated to the development and production of polyester-based synthetic materials. Three years ago, Isotech Products and its parent company successfully co-developed a type of sponge that features both superb air penetration and heat dissipation.

Founded in 1985, the firm supplies its proprietary "More Sorb" material to many leading Taiwanese suppliers of office chairs, and also to the world's No. 1 contract supplier of sports shoes, the Pou Chen Group, for use as shoe cushions. The material was originally designed for medical purposes. "We are awaiting the government' s GMP (Good Manufacturing Practices) certification to enable us to sell to the medical-item industry, but can already sell to manufacturers of non-medical products," explains H.B. Lee, company general manager. "We are expecting approval shortly."

Lee's company has done extensive testing on this material under many applications, with strongly positive results. The temperature on the surface of the "More Sorb" chair seat after normal usage of approximately 30 minutes is about 0.5 to 0.8 Celsius degrees lower than that on the surface of standard chairs. In addition, lab tests prove that the material, when used as a bandaging material for medical use, performs very well in wound-healing, with good air penetration. Best of all, says Lee, "More Sorb" has been recognized as a non-toxic material by the U.S. Federal Drug Administration, and the company received a citation recognizing the innovative material at the REHACare International 2003 medication trade show in Germany.

Chin Huang Hsin`s N102AG office chairs are outfitted with synthetic-fiber netting on seats and backs, greatly enhencing air penetration.

"'I can tell you that 'More Sorb' is absolutely a tremendous improvement in cushion materials for furniture--an area where the technology had not progressed much over a long period," Lee says. He attributes the company's accomplishment primarily to its strong R&D team of seven specialists, led by a vice president with a Ph.D. in materials science from the United States who served in heavyweight chemical-technology companies such as Bayer and DuPont for a combined 20-some years in the States.

"More Sorb" is by no means the company's first material designed for furniture use. The company has also developed PU and PV materials for chair seats, armrests, and chair backs. "Compared with PU and PV, however, 'More Sorb' is a much more effective furniture material," Lee emphasizes.

Some German furniture suppliers, Lee reports, have shown interest in procuring the "More Sorb" technology, and a number of South Korean manufacturers have placed orders. His company also hopes to co-produce the material with international furniture suppliers in promising markets. "At home, we hope our material can help furniture manufacturers develop high-end pieces so they may differentiate themselves from makers in the low end and mid-range, where overcrowding has led to intense price-cutting," Lee comments.

With the material now part of the company's product line, Lee expects his company's sales to increase sharply in 2004, from last year's NT$500 million (US$14.7 million at US$1:NT$34).

Chair-iots for the Office Warrior

Chin Huang Hsin Co., Ltd.'s N102AG office chairs have seats and backs outfitted with synthetic-fiber netting, effectively addressing the need for air-penetration. The company introduced the line around one year ago.

"These chairs enable sitters to remain much more comfortable than do sponge chairs," states company chairman Mike Lin. Each has a maximum load capacity of 200 kilograms, with the maximum force-resistance of the fiber netting one ton.

Thanks to a recent large-volume order from an American buyer, the company has been turning out 60,000 of the chairs a month from February, triple the original 20,000 in previous months which accounted for one-fifth of its total output.

Lin says the color of the chairs--black--is particularly attractive to European and American consumers. "Taiwanese and Japanese consumers prefer light colors," he notes.

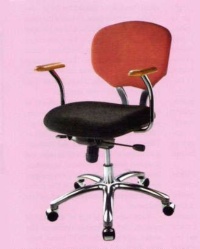

The N106AG design was, like the company's other models, done in-house. The chairs have sponge cushions in the seat and back, as most office chairs do, but are equipped with a T-shaped metal frame as the support for the seat upholstery, instead of the standard metal or wood board. According to Lin, the T-shape frame design is based on mechanical dynamics, which enables it to pillar the seat at major weight points and esults in savings on materials costs.

Another unique design is that the chair has a plastic cover which gives the chair a smooth look by concealing the T-shape frame inside the seat from the underside. On the back-side edge of the covering is a button used to adjust the height of the chair. On standard chairs, an adjustment handlebar is most common.

The N106AG's armrests are also adjustable. The space between one rest and the other can be widened to 700 mm, from the standard 500 mm, by simply pressing and releasing a control button on the plastic cover.

Lin points out that his company began introducing ODM-based products two years ago. "Competition in the OEM market has become ever more intense with more and more low-cost, price-undercutting mainland Chinese and Vietnamese rivals jumping into the market," Lin explains. However, he states that promotion of the more profitable ODM-based wares is not an easy job, with attractive exterior appearance crucial.

Fortunately, the competitive threat has intensified the links between Lin's company and its supporting partners, with the latter agreeing to cut their charges so that his company can lure back orders with more competitive quotes, leading to a virtuous circle with more contracts in return.

Like many other Taiwanese office-furniture suppliers, Lin's company has begun contracting Taiwanese manufacturers operating in mainland China to supply it parts, with the company assembling and exporting from Taiwan to cut costs. The parts are made of a variety of materials, but not wood. Lin says that his company has stopped using wood boards, at least for the foreseeable future, to make its products as different from the average manufacturers' as possible. "Currently, most still equip their chairs with wood boards to support the seat upholstery," he notes.

To deal with the heat-dissipation problem, Chuen Lei Enterprise Co., Ltd. Plans to roll out chairs coming with nanometer upholstery in the second half of this year. "We have worked on this material in cooperation with a materials supplier for a while, successfully overcoming all difficulties regarding their application to chair seats," says company president C.J. Lai.

The company will also present chairs furnished with PVC seats to cater to Japanese consumers, and chairs designed in cooperation with ergonomics specialists. The ergonomic chairs will feature a back that can be tilted backward at many angles.

His company launched its OEM operations around three years ago. "In the OEM market, it's not you but buyers who determine trade prices. But in the ODM market, you decide the prices and profit margins," Lai states, adding that he has seen many Taiwanese OEM-based manufacturers fall at the feet of the competition. To boost its ODM strength, Chuen Lei has worked on new designs with several brand-name furniture suppliers in the United States (Colovos), Europe, and Japan.

Lai's company is not always on the defensive in terms of price-undercutting, he says. Chuan Lei will soon be able to churn out products that are much cheaper than those produced by mainland Chinese suppliers, without compromising the quality. The firm has teamed up with parts suppliers to invest in integrated production lines. Three years ago, Lai's company opened a 30,000-ping factory at an investment of around NT$300 million (US$8.8 million at US$1:NT$34) in mainland China, in tandem with 20-some parts and material suppliers. "We have since the beginning of this year pursued the goal of developing and making all parts in-house, to better control costs, quality, and the technology used."

Lai projects the mainland Chinese factory will have revenue of NT$2 billion (US$59 million) this year, rising from last year's NT$1.2 billion (US$35 million). The Taiwan headquarters will post revenue of NT$200 million (US$5.8 million), also representing an increase.

Another advantage for Taiwanese furniture suppliers shifting to original equipment manufacturing and own-brand identification are the recent anti-dumping measures the U.S. government and the European Union have slapped on mainland China-made furniture, Lai states. "The action mostly addresses unacceptably low-priced OEM-based wares. So, I feel ODM-based and own-brand products will have ample room in the market this year."

The Chuen Lei chairman points out that the primary disadvantage for Taiwanese furniture suppliers is the still higher cost of materials, which have eaten into profits. Nevertheless, he is confident that his company's close cooperation with materials and parts suppliers will help significantly cut his company's costs.

Sun Shining on This Firm

Henn Sun Co., Ltd. Has emphasized more on looks of its chairs than on heat-dissipation solution. As an ODM since establishment six years ago, the company has counted on its designs. Recently, the company rolled out its second collection of self-designed chairs, the HS-2036 family.

The new chairs are equipped with forged aluminum lumbar-support bars. The slim curve of the bars, according to company owner Jeff Lo, is his idea based on the elegant curve of goblets. Good look has won the bar patents in the United States, Taiwan and mainland China. Lo notes that aluminum is lighter and more durable than steel. Also, forging aluminum is a process much more complicated and costly as compared with pressing steel. "When it comes to process related to forging, it must be done with molds. Building molds usually costs a big money," Lo stresses. He spent around NT$6 million (US$176,500) on the bar molds.

All the spending is close to paid-off as some big office-furniture suppliers on the island and overseas have been talking orders for the chairs.

Lo's first patented chair was its future-look NL-1 family of chairs. This family is equipped with a streamlined one-piece back, making it look like chairs on the Enterprise space ship in the movie Star Trek. This chair also cost Lo huge money on molds. However, it also won his company considerable orders.

Lo himself is an idealist, who has been pursuing the goal of designing a chair that is suitable for everyone. "So, you can see my designs all come from scratch, basing on no precedents," he reports. What makes him feel regretful is that his company cannot afford too many new designs every year because of limited financial capability. "So, I can choose only a few ideas for my new designs and this increases operation risk if none of them is marketable," he laments. Fortunately, his NL-1 and HS-2036 families are popular.

Even though Lo has been diligently collecting market information through important trade shows in order to keep his products trendy, he still feels great pressure as fundamental changes come ever more quickly. "Buyers from different markets around the world may not buy your attractive products at first sight, continually contacting you to discuss their needs in relation to your designs. But if you stop offering new designs, they will stop visiting you for sure," he notes.

Over the past few years, Lo's business has increased at an acceptable pace, while many of his industrial peers at home have complained of limited returns because of the global recession. He attributes his company's moderate but steady growth mostly to its superior design work.

The company's designs, Lo says, mostly target European consumers, avoiding competition with low-price manufacturers focusing on the vast U.S. market. The company contracts only one dealer in each marketplace so that in-fighting for market share among dealers can be avoided.

©1995-2006 Copyright China Economic News Service All Rights Reserved.