Leading Taiwan Auto-Parts Maker Conquers U.S., Eyes Europe

Oct 14, 2005 Ι Industry News Ι Auto Parts and Accessories Ι By Quincy, CENS

Taiwan's Gordon Auto Body Parts Co. has already captured 30% of the American market for aftermarket (AM) sheet-metal body parts and is now taking aim at Europe. The company ignored Europe in the past because it was fully occupied with the United States market and because AM parts account for only 2-3% of the total auto-repair market in Europe, compared with about 15% in the U.S.

Gordon's appetite for Europe was whetted by the new Automotive Block Exemption Regulation (BER) 1400/2002/EC, which came into force on Oct. 1, 2002 but provided for a buffer period lasting through 2003. The new regulation provides a legal framework for motor-vehicle distribution and service agreements, and aims to foster more competition in auto sales, service, and parts by giving drivers the right to have their vehicles serviced, maintained, and repaired in a shop of their choice, and at prices set through free competition. The regulation opens up a free market for AM auto parts throughout Europe with the exception of certain countries, such as France, which still insist on protecting their own automotive industries.

"The new BER opens up new opportunities for AM parts makers that want to tap the growing European market, " comments Sonny Pan, vice president of Gordon Auto Body Parts. "More importantly, the new directive offers a fair competition mechanism for the region. The biggest AM parts buyers will be auto-insurance companies, which want to use more AM parts to repair insured vehicles so as to cut costs and strengthen competitiveness. First, though, the parts they use have to be certified for safety and quality.

"With the new BER, the core competitiveness of AM parts suppliers is the number of their products that are certified by mainstream European standards organizations. So the mainstream quality-accreditation systems, including Thatcham in the United Kingdom and Certo Zaragoza in Spain, are the new competition thresholds and they constitute a fair starting line for interested suppliers."

The Insurance Company Connection

Gordon has a head start in this business, since it maintains close ties with auto-insurance companies rather than individual distributors. Unlike most other AM body-parts suppliers in Taiwan, which generally do their own production and trading in the small-batch, large variety mode of operation, Gordon supplies parts to the U.S. market in large volumes. It does little trading on its own, unless customers specifically request it.

"We always do business in niche markets, " Pan notes. "In North America we were able to gain such a solid foothold because the major quality accreditation bodies, such as the Certified Automotive Parts Association (CAPA) and the Manufacturers' Qualification and Validation Program (MQVP), provided us with a niche market. Now we think that the new BER will provide a new niche for us in Europe, and allow us to repeat our experience on the other side of the Atlantic."

Pan says that his company became aware of the post-BER potential of the European market when a representative from Thatcham came to Taiwan and called them. Thatcham, it seems, originally wanted to develop a parts-certification business with parts suppliers in Europe, but discovered that companies on the continent made too few items to meet the needs of auto-insurance companies.

The limited range of items supplied by European parts makers, Pan explains, is due to the fact that before the BER came into force, insurance companies could not repair insured cars using AM parts. In addition, he adds, the AM parts business requires large and continuous injections of cash into the development of molds and dies if a comprehensive range of products, and thus competitiveness, is to be maintained.

Since European insurance companies are now allowed to use AM parts, Pan says, major auto insurers there have asked Thatcham to provide for the supply of 250 certified AM parts this year. While Thatcham started out in the U.K., it is recognized by an increasing number of European countries as a mainstream quality-accreditation system; even Germany, whose TUV Rheinland plays a vital role in certifying original equipment (OE) parts, is thinking about recognizing Thatcham's certification.

To meet the expected new demand from Europe, Gordon has decided to develop 25 sets of molds and dies for 40-50 product items every year for new European car models. "European auto-insurance companies need Taiwan suppliers to provide high-quality, competitively-priced AM parts, " Pan comments, "and Taiwanese companies need this new market for their global business expansion.

Explosive Growth Ahead

"For Gordon, we anticipate explosive growth in our European sales once the number of our Thatcham-certified products reaches a certain level during the next few years. This will repeat our experience in America."

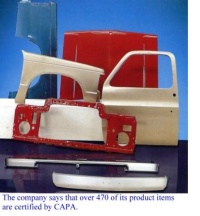

The company became the largest supplier of sheet-metal body parts to the U.S. market largely by getting almost all of its products certified by mainstream certification systems there. Its product line currently includes 470 CAPA-certified items; now, it offers 25 Thatcham-certified items as well. With the company pouring an average of NT$500 million (US$15.8 million at NT$31.3:US$1) into the development of 80 to 100 sets of molds and dies every year, the number of certified items will continue to grow.

Gordon employs a work force of about 400 and is listed on the Taiwan Stock Exchange. Its revenues grew by 25% last year, to NT$2.56 billion (US$82 million), and a further 15-20% increase is expected in 2005. Pan is proud of the firm's vertical integration, boasting that no other sheet-metal body-parts maker in Taiwan has its own in-house mold and die development workshops. To keep raw material coming in steadily, the company signs long-term supply agreements with major steel suppliers.

The firm operates two plants in Taoyuan County, northern Taiwan, and will finalize the location for a new plant in mainland China in the third quarter of this year. Pan says that Gordon will continue concentrating mainly on the AM-parts business, although it may possibly supply OE parts too at some time in the future.

Among the factors that will affect business in the North American market this year, Pan says, is rising oil prices; this is expected to cut into parts sales as drivers drive less or switch to public transportation. This means fewer cars on the roads, fewer collisions, and a reduced demand for replacement parts.

However, Pan goes on to point out a promising phenomenon: "Some major auto brands, like Ford and DaimlerChrysler, are constantly asking their original equipment service (OES) providers to sell (CAPA-certified) AM parts as well as OE replacement parts in a bid to make the parts-sale systems more profitable." This is expected to help Taiwanese AM parts suppliers to boost their sales in the U.S. (June 2005)

Gordon's appetite for Europe was whetted by the new Automotive Block Exemption Regulation (BER) 1400/2002/EC, which came into force on Oct. 1, 2002 but provided for a buffer period lasting through 2003. The new regulation provides a legal framework for motor-vehicle distribution and service agreements, and aims to foster more competition in auto sales, service, and parts by giving drivers the right to have their vehicles serviced, maintained, and repaired in a shop of their choice, and at prices set through free competition. The regulation opens up a free market for AM auto parts throughout Europe with the exception of certain countries, such as France, which still insist on protecting their own automotive industries.

"The new BER opens up new opportunities for AM parts makers that want to tap the growing European market, " comments Sonny Pan, vice president of Gordon Auto Body Parts. "More importantly, the new directive offers a fair competition mechanism for the region. The biggest AM parts buyers will be auto-insurance companies, which want to use more AM parts to repair insured vehicles so as to cut costs and strengthen competitiveness. First, though, the parts they use have to be certified for safety and quality.

"With the new BER, the core competitiveness of AM parts suppliers is the number of their products that are certified by mainstream European standards organizations. So the mainstream quality-accreditation systems, including Thatcham in the United Kingdom and Certo Zaragoza in Spain, are the new competition thresholds and they constitute a fair starting line for interested suppliers."

The Insurance Company Connection

Gordon has a head start in this business, since it maintains close ties with auto-insurance companies rather than individual distributors. Unlike most other AM body-parts suppliers in Taiwan, which generally do their own production and trading in the small-batch, large variety mode of operation, Gordon supplies parts to the U.S. market in large volumes. It does little trading on its own, unless customers specifically request it.

"We always do business in niche markets, " Pan notes. "In North America we were able to gain such a solid foothold because the major quality accreditation bodies, such as the Certified Automotive Parts Association (CAPA) and the Manufacturers' Qualification and Validation Program (MQVP), provided us with a niche market. Now we think that the new BER will provide a new niche for us in Europe, and allow us to repeat our experience on the other side of the Atlantic."

Pan says that his company became aware of the post-BER potential of the European market when a representative from Thatcham came to Taiwan and called them. Thatcham, it seems, originally wanted to develop a parts-certification business with parts suppliers in Europe, but discovered that companies on the continent made too few items to meet the needs of auto-insurance companies.

The limited range of items supplied by European parts makers, Pan explains, is due to the fact that before the BER came into force, insurance companies could not repair insured cars using AM parts. In addition, he adds, the AM parts business requires large and continuous injections of cash into the development of molds and dies if a comprehensive range of products, and thus competitiveness, is to be maintained.

Since European insurance companies are now allowed to use AM parts, Pan says, major auto insurers there have asked Thatcham to provide for the supply of 250 certified AM parts this year. While Thatcham started out in the U.K., it is recognized by an increasing number of European countries as a mainstream quality-accreditation system; even Germany, whose TUV Rheinland plays a vital role in certifying original equipment (OE) parts, is thinking about recognizing Thatcham's certification.

To meet the expected new demand from Europe, Gordon has decided to develop 25 sets of molds and dies for 40-50 product items every year for new European car models. "European auto-insurance companies need Taiwan suppliers to provide high-quality, competitively-priced AM parts, " Pan comments, "and Taiwanese companies need this new market for their global business expansion.

Explosive Growth Ahead

"For Gordon, we anticipate explosive growth in our European sales once the number of our Thatcham-certified products reaches a certain level during the next few years. This will repeat our experience in America."

The company became the largest supplier of sheet-metal body parts to the U.S. market largely by getting almost all of its products certified by mainstream certification systems there. Its product line currently includes 470 CAPA-certified items; now, it offers 25 Thatcham-certified items as well. With the company pouring an average of NT$500 million (US$15.8 million at NT$31.3:US$1) into the development of 80 to 100 sets of molds and dies every year, the number of certified items will continue to grow.

Gordon employs a work force of about 400 and is listed on the Taiwan Stock Exchange. Its revenues grew by 25% last year, to NT$2.56 billion (US$82 million), and a further 15-20% increase is expected in 2005. Pan is proud of the firm's vertical integration, boasting that no other sheet-metal body-parts maker in Taiwan has its own in-house mold and die development workshops. To keep raw material coming in steadily, the company signs long-term supply agreements with major steel suppliers.

The firm operates two plants in Taoyuan County, northern Taiwan, and will finalize the location for a new plant in mainland China in the third quarter of this year. Pan says that Gordon will continue concentrating mainly on the AM-parts business, although it may possibly supply OE parts too at some time in the future.

Among the factors that will affect business in the North American market this year, Pan says, is rising oil prices; this is expected to cut into parts sales as drivers drive less or switch to public transportation. This means fewer cars on the roads, fewer collisions, and a reduced demand for replacement parts.

However, Pan goes on to point out a promising phenomenon: "Some major auto brands, like Ford and DaimlerChrysler, are constantly asking their original equipment service (OES) providers to sell (CAPA-certified) AM parts as well as OE replacement parts in a bid to make the parts-sale systems more profitable." This is expected to help Taiwanese AM parts suppliers to boost their sales in the U.S. (June 2005)

©1995-2006 Copyright China Economic News Service All Rights Reserved.