Taiwan's Machinery Industry: From Challenges to Opportunities in Industrial Paradigm Shift

2023/07/21 | By Andrew Hsu

In the abovementioned scenario though, Taiwan's machinery industry has managed to maintain its competitiveness in the global market. According to the statistics compiled by the Taiwan Association of Machinery Industry (TAMI), the industry witnessed consistent growth in export value throughout the first half of 2022. Later then, however, the looming stalemate in the war between Russia and Ukraine has impacted the global market, as Taiwan's machinery industry witnessed its eighteen-month export growth streak ended suddenly during the second half. For the whole year, fortunately, Taiwanese suppliers still together achieved an impressive export value of US$34,813 million, representing a 5.1% year-on-year growth at an all-time high, with production value hitting an unprecedented mark of NT$1.45 trillion.

The outlook for 2023 seems gloomy to Taiwan's machinery industry, as the persistent challenging circumstances continue to weaken the global economic momentum. To insiders, adding salt to their injury is the depreciating Japanese yen (JPY), which has spiraled downward by more than 30% against the greenback since August 2019, and as a result further neutralized Taiwanese suppliers' price advantages in the global market. Additionally, on January 4th of this year, the Bureau of Foreign Trade, Ministry of Economic Affairs (MOEA) expanded trade sanctions against Russia and Belarus, by including machine tools in the control list of strategic high-tech commodities (SHTC). This decision can add to the Taiwanese machinery industry's woes, given that Taiwan's machine tool exports to Russia posted continued growth in 2022.

Despite the prevailing challenges, Taiwanese suppliers who still look at China and the US may be disappointed to some extent, especially when the two countries for the decade have served as growth engines for the industry. Taiwanese suppliers exported 30.9% of their machinery to China in 2021 and then saw the figure drop to 25.9% in 2022 when the world's once most populous country was still fretted by the Covid-19 pandemic. From January through April 2023, Taiwan's machinery export value to the country declined 23.0% compared to the same period last year. On the other hand, the US contributed 22.2% to Taiwan's overall machinery export value in 2021, and then 25.6% in 2022. However, the growth rate started to slow down from January to April 2023 to only 24.7%.

The data shown above indicate that Taiwanese suppliers are prone to geopolitical risks. A further proof is that the Chinese government's implementation of stringent zero COVID policy and the "Repatriate offshore funds to Taiwan" policy has undermined machinery imports from Taiwan. And such political problems, in turn, force Taiwanese suppliers to count more on the domestic market than ever. In the past, domestic machinery sales accounted for around 5% of the industry's total, but the share has now surpassed 20%.

According to statistics by TAMI, the export value during January and April 2023 amounts to US$9,414 million, indicating a 20.1% year-on-year decline. Nevertheless, export value for April alone showed a 3.2% increase, equivalent to US$79 million more than a year ago. The good news to insiders is that the industry's monthly export value remains on an upward trend for the time being.

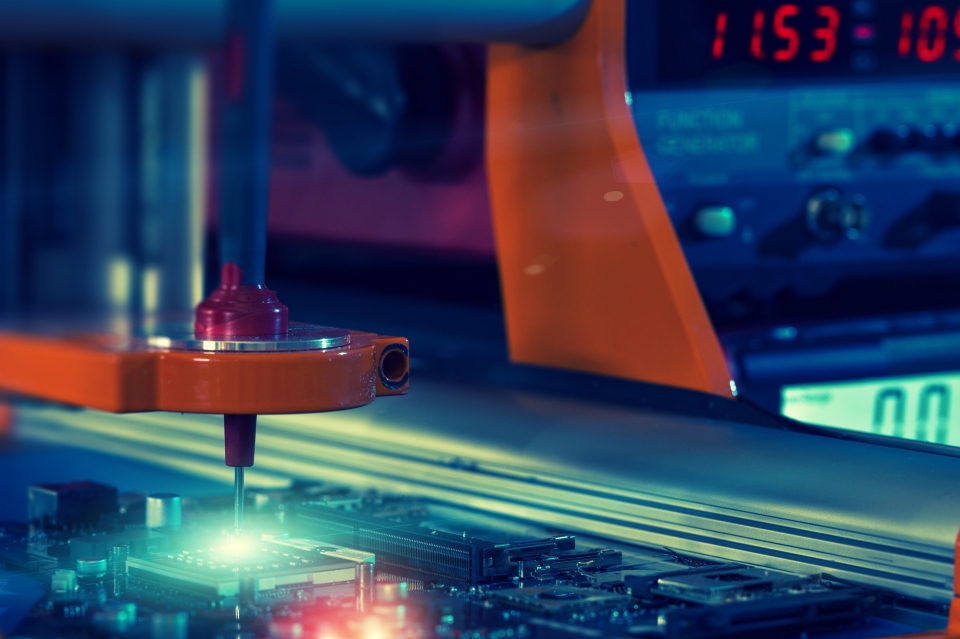

Among all the product categories, "inspecting and testing equipment" and "electric machinery" are the top sellers between January and April. The former accounts for 15.5% of total exports and is worth US$1,461 million, while the latter contributes 15.2% or US$1,434 million to the total. Given that such machines are mainly used in semiconductor production, the figures mentioned above suggest that Taiwan's semiconductor industry has been kept in good shape to benefit its suppliers. Last but not least, the machine tools are Taiwan's third best-seller during the same period of time, which generated more than US$824 million in export.

Furthermore, on May 5th, the WHO chief declared the end of COVID-19 as a global health emergency. This has helped show organizers worldwide who had been forced to suspend exhibitions for a few years to regain steam and reinvigorate global trade, with some already witnessing significant recovery in exhibitor and visitor numbers. In light of these positive trends, TAMI expects that export levels will rise in the third quarter at the earliest, and the projected order value for 2023 will be on par with that of 2022. To expedite the industry's recovery, TAMI is committed to providing resources such as marketing guidance, assistance with technological upgrades, Toyota Production System (TPS) support, facilitation of digital transformation, ESG implementation, and machinery talent training.

Also, the current US-China trade war is driving global supply chains into a new phase, characterized by an emphasis on resiliency, safety, sustainability, advanced technology, and regional economic development. To navigate this shifting landscape, the Industrial Technology Research Institute (ITRI) advises that Taiwan's machinery industry should capitalize on its information and communications technology (ICT) capabilities to forge partnerships around the world.

In addition, given the ongoing phenomenon of deglobalization, enhancing industrial resilience is crucial for machinery suppliers in Taiwan. This can be achieved by adjusting production bases and implementing market diversification strategies. Additionally, Taiwan suppliers can also engage themselves in green transition and industrial upgrading, while simultaneously strengthening the development of ICT technologies to add value to their products. It is believed that the current crisis can serve as a catalyst for transformation, positioning Taiwan's machinery industry as a winner in this era of industrial paradigm shift.