Global Automobile Market Shows Signs of Recovery in 2010

Challenges and uncertainties lay ahead,

2010/04/06 | By Quincy LiangThe financial crisis continued to take a heavy toll on global automotive industry in 2009. Worldwide shipments of new cars fell, auto and parts makers went bankrupt, and governments rolled out economic stimulus programs to keep their automotive industries afloat.

But after a punishing first half of the year, signs of recovery have popped up since the third quarter. The International Monetary Fund (IMF) predicted that the global economy would see an uptick in the fourth quarter of 2009 or the first quarter of 2010. Consumer confidence was emboldened by signs of economic recovery, and new-car purchases improved with the carrot of government subsidy programs.

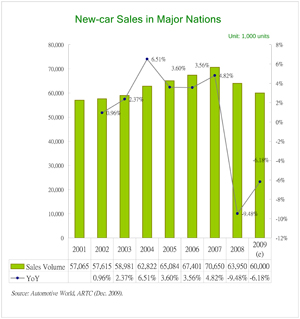

About 60 million new cars were sold worldwide in 2009. This was a 6.1% year-on-year (YoY) drop, but the rate of decline slowed from the 9.48% YoY plunge in 2008.

The Automotive Research & Testing Center (ARTC), the most important vehicle testing, inspection, and development hub in Taiwan, recently released a report outlining the status all major auto markets worldwide in 2009 and casting a forecaster's eye to 2010.

Major Markets

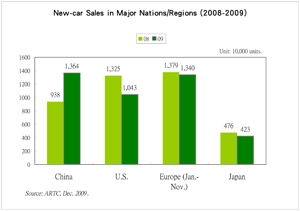

Among industrialized nations, the United States suffered the steepest drop in new-car sales in 2009. Only 10.43 million new cars were sold in once the world's largest single market last year, a decline of 2.82 million units from previous year. In the first 11 months of 2009, some 13.4 million new cars were shipped in Europe, a fall of just 390,000 units from the previous year. In Japan, about 4.23 million new cars were licensed in the first 11 months of 2009, a decline of 530,000 units. In China, however, automobile sales surged to 13.64 million units, a gain of 4.26 million units from the year earlier, displacing the U.S. as the world's largest auto market.

The U.S.

Chrysler and General Motors (GM) filed Chapter 11 in late April and June, respectively, marking a new nadir in America's once globally dominant automotive industry. The government attempted to throw the industry a life line with the "cash for clunkers" program, but sales in 2009 still dropped by 17.2% YoY.

Europe

According to the European Automobile Manufacturers' Association, new-car sales in Europe dropped by 2.8% in the first 11 months of 2009, YoY, but the rate of decline slowed from the previous year.

Sales gains were seen in a few countries with the help of government subsidies, including France, Germany, Austria, Czech, and Slovakia.

The French government provided a 1,000-euro subsidy for new-car buyers replacing vehicles at least 10 years old. The German government offered a 2,500-euro subsidy (with total subsidy value of 1.5 billion euro) for new car purchases.

In Italy, the government offered subsidies of 500 to 1,500 euro (with total budget of 1.2 billion euro) for the purchase of low-emission new cars or powered two-wheelers (PTWs), slowing the pace of the YoY fall in new-car sales to just 1.4%.

New-car sales in the first 11 months in other major European nations saw YoY declines at various levels, including an 8.8% drop in the U.K., a 12.5% to 23% slide in Spain, Belgium, and the Netherlands, and a 78.6% plunge in financially-gridlocked Iceland. Sales of new automobiles in most new European Union (EU) member nations reported decreases, with the exceptions of Slovakia (up 10.7% YoY), Czech (up 10.1%), and Poland (up 0.5%).

China

Thanks to many government incentives, including subsidies for light passenger cars and mini commercial vehicles in rural and some urban areas, new-car sales in China continued to climb to a new high in 2009. China replaced the U.S. as the world's largest single automobile market last year, with a lead of 3.03 million units.

Japan

Sales of new cars with conventional internal combustion engines (ICEs) in Japan in the first 11 months of 2009 fell 11.2% YoY. Government incentives for the purchase of environment-friendly vehicles helped sales of hybrid electric vehicles (HEVs) to leap by 172% YoY in the first nine months of 2009 to 223,000 units.

Taiwan

New-car sales in Taiwan grew strongly in late 2009. Purchase willingness was deterred by the weak consumer confidence early last year, driving the government to push a subsidy program of NT$30,000 (US$923, through commodity-tax reduction) for each new car sold with engine displacements under 2,000cc.

A total of 294,000 new cars were sold on the island last year, up 28.3% YoY, sweeping away the market nightmare of the previous three years. Industry experts, however, worry that the subsidies have merely encouraged people to buy earlier than they would have, setting the stage for a potentially sharp decline in the first half of 2010.

The top-six auto sellers in Taiwan remained unchanged in 2009 from the previous year, including Hotai Motor Co. Ltd. (Toyota and Lexus), China Motor Corp. (Mitsubishi), Yulon Nissan Motor Co., (Nissan), Honda Taiwan Motor Co. (Honda), Ford Lio Ho Motor Co. (Ford), and Mazda Taiwan (Mazda). Toyota remained the biggest auto brand with an 18% share of the domestic market. Toyota sold over 111,000 units last year, nearly equally the combined total of the No. 2 to No. 4 makers. Honda Taiwan's sales volume exceeded Ford Lio Ho for the first time in 2007 to win the No. 4 position, and it further consolidate its place last year.

Global Auto and Parts Makers

The bankruptcy filings of Chrysler and GM in mid-2009 have sparked a reshuffle in the global automobile market. The "new GM" will keep only four family brands, including Chevrolet, GMC, Buick and Cadillac. Other nameplates, including Hummer, Saab, Saturn, will be sold. Pontiac will close.

Canadian tier-one auto-parts maker Magna has tied up with Russian bank Sberbank to acquire a 55% stake in Opel and Vauxhall of GM.

Italian auto conglomerate Fiat reached an acquisition agreement with Chrysler in June 2009 to acquire the American counterpart; while Jeep of the previous Chrysler Group was merged into the Nissan-Renault Group.

Ford, the only top-three U.S. automaker that did not seek rescue help from the government, sold its Jaguar and Land Rover subsidiaries to Indian automaker TATA Group. Volvo, also under the Ford Group, was acquired by Geely Automobile Holdings Ltd. of China.

Global tier-one parts makers continued to face a challenging business environment in 2009. Since late 2008, several leading parts suppliers have filed for bankruptcy, including major plastic auto-parts suppliers Cadence and Key Plastic. Canadian plastic-parts maker Craytech, American cast-parts supplier Contech, German parts company Stankiewicz filed Chapter 11 in January 2009. Australian automatic transmission supplier DSI was acquired by Chinese automaker Geely in February last year. The English subsidiary of Canadian automotive-electronic parts supplier Visteon and Swedish plastic-parts maker Plastal filed bankruptcy in term in March. Nippon Kashuha of Japan, Noble International, Mark IV, Hayes Lemmerz, Ward, Crucible, American Visteon, and Lear also filed Chapter 11 between March and July of 2009.

2010 Outlook

The 2010 global automobile market saw signs of recovery in the first month of the year, but challenges and uncertainties lay ahead, including the global economy, fuel prices, and consumer confidence.

The U.S. Federal Reserve declared the recession over as in August 2009 and the IMF raised its forecast for global economic growth to about 3% in 2010. But consumer confidence remains under siege.

Gas prices began falling in early 2009 with the global recession. But the New York Mercantile Exchange (NYMEX) light crude oil future prices climbed from US$36.51 a barrel to US$83.43 on January 10 of 2010. Higher prices at the pump are expected to hinder the recovery of global auto sales.

Alternative-energy vehicles will be a major development target for global automakers in 2010 and onward. Environmental consciousness and high gas prices are prompting automakers to develop low-emission and fuel-saving cars as the engines of growth in the year ahead.

China has announced several policies that are expected to continue the auto sales boom there. The government there is extending subsidies for automobile purchases in rural areas to the end of 2010, and motorcycle subsidies will be drawn out to January 31, 2013. The government is also increasing subsidies for old-vehicle replacement to RMB5,000~18,000. And it is extending a commodity tax break for light cars with engine displacements under 1,600cc to the end of 2010, though the reduction will be just half of the previous break.

Currently, automobile ownership in China is about 40 vehicles per 1,000 people, compared to 600 in the U.S. and 139 in the whole world. The demand for vehicles in China is expected to grow rapidly in pace with the nation's growing wealth.

New-car Sales in Taiwan (2000-2009) | |||||||||||

Year | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |

Locally made | Volume | 356,546 | 291,307 | 345,211 | 357,285 | 422,410 | 444,470 | 302,076 | 186,750 | 268,197 | 234,018 |

YoY | -1.80% | -17.84% | 18.50% | 3.50% | 18.23% | 5.22% | -32.03% | -30.37% | -11.22% | 25.3% | |

Share | 84.82% | 83.85% | 86.54 | 86.32% | 87.22% | 86.37% | 84.70% | 81.37% | 84.04% | 79.4% | |

Imported | Volume | 63,918 | 56,113 | 53,671 | 56,629 | 61,882 | 70,157 | 54,695 | 42,745 | 50,937 | 60,405 |

YoY | 5.70% | -12.06% | -4.35% | 5.51% | 9.28% | 13.37% | -22.03% | -16.08% | -6.87% | 41.3% | |

Share | 15.18% | 16.15% | 13.46% | 13.68% | 12.78% | 13.63% | 15.30% | 18.63% | 15.96% | 20.6% | |

Total | Volume | 420,464 | 347,420 | 398,882 | 413,914 | 484,292 | 514,627 | 356,771 | 229,495 | 319,134 | 294,423 |

YoY | -0.73% | -17.35% | 14.81% | 3.77% | 17.00% | 6.26% | -30.67% | -28.09% | -10.55% | 28.3% | |

Source: Taiwan Transportation Vehicle Manufacturers' Association (TTVMA), ARTC | |||||||||||